How to Manage Cash Flow Smartly: A Step-by-Step Guide

Whether you’re running a parts distribution business, managing a retail outlet, or operating an auto workshop, maintaining smart cash flow is essential for survival and growth. For automotive entrepreneurs like those in the Beekay Group network, mastering cash flow management can mean the difference between steady acceleration and unexpected breakdowns. Here’s a comprehensive guide to help you manage cash flow smartly and ensure your business engine keeps running smoothly.

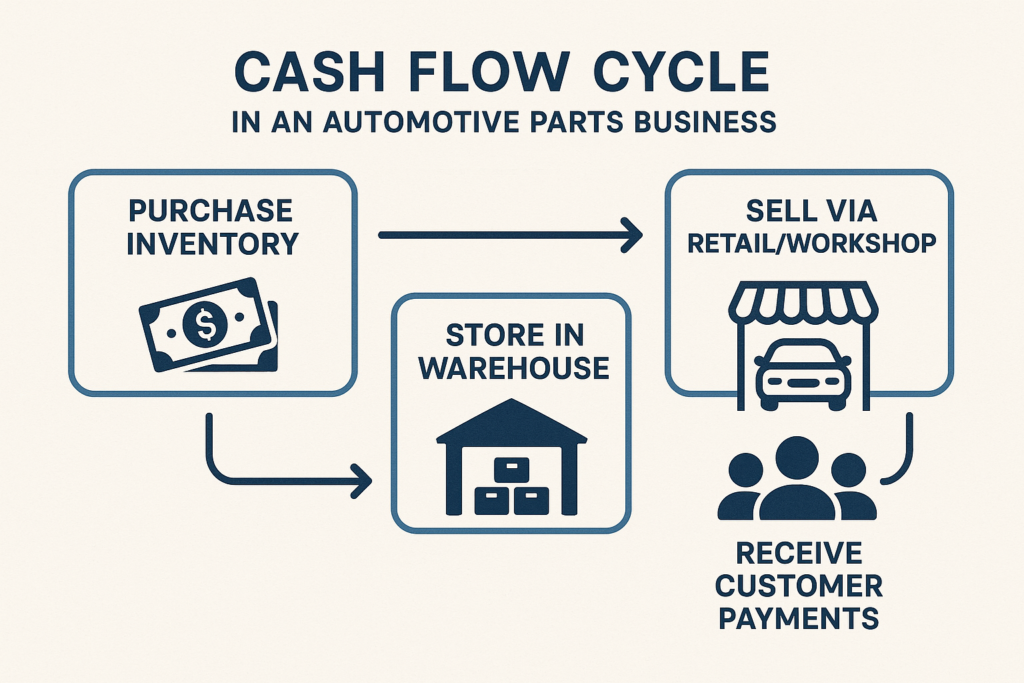

1. Understand Your Cash Flow Cycle

Start by mapping out your entire cash flow cycle. In the automotive aftermarket, the cycle typically includes:

-

Purchasing inventory from OEM partners (like Eicher, Maruti Suzuki, Mahindra)

-

Holding stock in warehouses

-

Selling through retail or workshop outlets

-

Collecting payments from customers (B2B or B2C)

Understanding when money comes in and goes out allows you to plan accordingly and avoid shortfalls.

2. Forecast Cash Inflows and Outflows

Project future cash flow based on your historical sales data, seasonal trends, and current market dynamics. At Beekay Group, for instance, cash inflows peak during service-heavy seasons, while outflows increase with inventory restocking and operational costs.

Tips:

-

Use accounting software or cash flow management tools

-

Monitor weekly and monthly forecasts

-

Prepare for delays in receivables

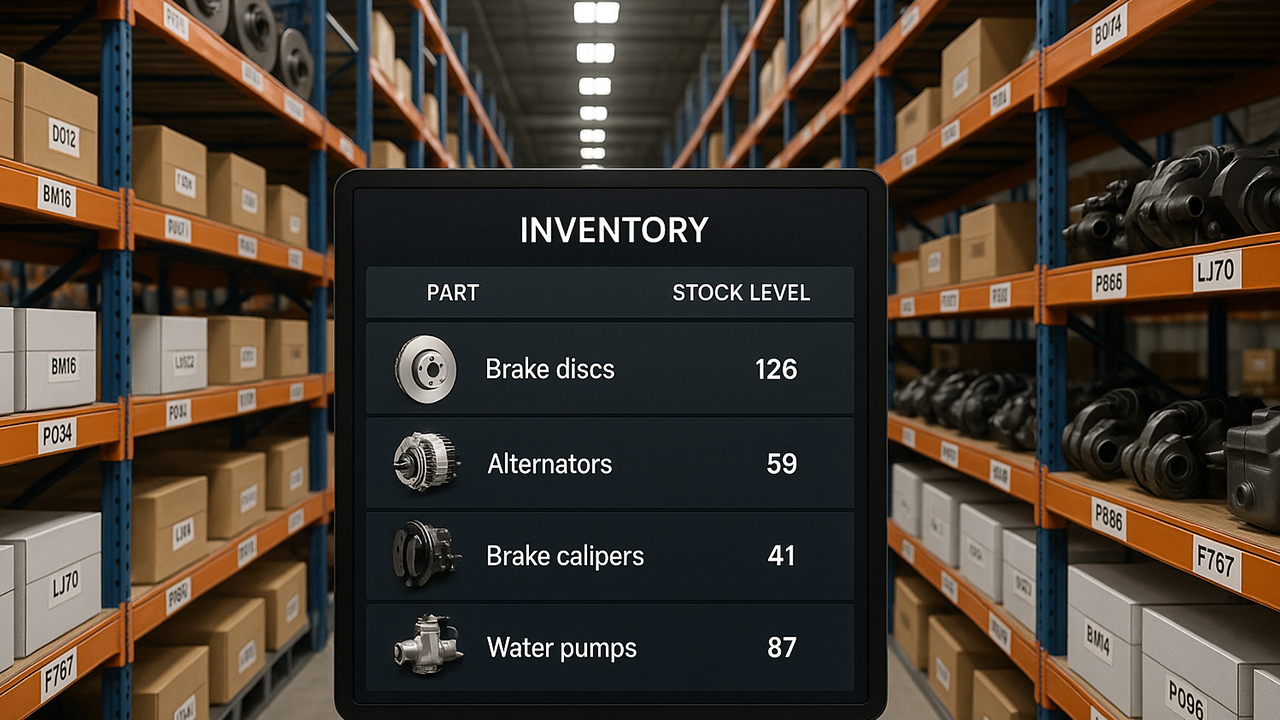

3. Optimize Inventory Levels

One of the biggest cash drains in the automotive sector is overstocking. While Beekay’s 17 warehouses and 42 retail outlets require a robust inventory, smart planning ensures you’re not tying up cash in slow-moving SKUs.

Smart Inventory Practices:

-

Use demand forecasting tools

-

Focus on high-velocity SKUs

-

Leverage vendor-managed inventory where possible

4. Strengthen Your Receivables Process

Delayed payments can cripple your business. Keep your receivables process lean and proactive:

-

Offer incentives for early payments

-

Send timely reminders

-

Maintain strong relationships with key customers

In Beekay’s case, maintaining transparency and trust with over 7,000 mapped customers ensures smoother transactions.

5. Control Operational Costs

Evaluate your monthly expenses, from warehouse rents to staff salaries and logistics. Categorize them as fixed or variable and look for areas to trim fat without compromising service.

Cost Control Ideas:

-

Consolidate shipments

-

Automate routine tasks

-

Outsource non-core functions like payroll or IT

6. Build a Cash Reserve

Set aside part of your monthly profit to build a buffer fund. This reserve can help during emergencies like market slumps or sudden repair costs at workshops.

Start Small:

-

Save 5-10% of net income monthly

-

Keep it in a high-yield savings account or liquid mutual fund

7. Invest in Financial Literacy and Tools

Educate your team and yourself about basic financial management. Use tech tools to track KPIs like DSO (Days Sales Outstanding), gross margin, and burn rate.

Beekay’s financial leadership, including experienced CFOs and Finance Controllers, rely on data-backed insights to steer financial decisions—something every business can emulate at scale.

Final Thoughts

Smart cash flow management isn’t just about numbers—it’s about strategic thinking, proactive planning, and agile decision-making. By implementing these steps, automotive entrepreneurs can ensure their business drives forward—smoothly, profitably, and without unexpected financial hiccups.